Health Reimbursement Arrangements (HRA) can benefit your business. Understand how they work and how to get started in this guide.

How can I make health expenses tax deductible?

For child care business owners, staff, and educators, health care can be a major cost and substantial employment benefit. But for many child care businesses, the cost of health care plans can be expensive. Accordingly, some child care businesses are looking at more affordable options for health care that can benefit the owner and employee, but not swamp the business’s budget.

One of the most versatile and easy-to-implement options is a Health Reimbursement Arrangement (HRA), formally known as a Section 105 Plan. These plans can work for the single business owner of a family child care home who has an employee to the large child care organization with multiple centers, and everything in between.

In this guide, we will review what an HRA is, how it benefits employers and employees, and how to set one up.

What is an HRA?

An HRA provides a way to reimburse medical expenses for employees and their families. By taking these expenses and making them a business expense, the money associated with them is no longer subject to income or corporate taxes. These savings can add up.

How does an HRA work?

When you set up a plan, you set a limit to the total amount of health expenses that can be covered in a month or year for each employee and their family members. The limit needs to be the same for all employees (so an owner can’t have a greater reimbursement for example).

You can administer your own plan or use a company to do so. Regardless, employees will submit appropriate expenses for review and reimbursement up to their limit. If an employee doesn’t hit their limit for the year, the business owner does not have additional financial responsibility. For example, if you have a limit of $1,500 in annual reimbursements and your employee only submits $900, you only pay $900.

Step 1

Employer decides how much to contribute and on what schedule

Step 2

Employee has medical expense and pays for it

Step 3

Employee submits receipts for reimbursement

Step 4

HRA reimburses employee’s expenses

What kinds of costs will an HRA cover?

These plans cover a wide array of costs including:

Costs including deductibles and copays for checkups, surgery, and other services

Health insurance and long-term care premiums

Dental health and surgery

Prescriptions

Vision health and surgery

Eyeglasses (prescription and reading glasses) and contacts

Laboratory fees

Medical imaging and X-rays

Counseling

OB/GYN fees

Specialized schools

Medical devices such as walking aids

Vaccinations

Physical therapy

Infertility treatment

Over-the-counter health costs when prescribed by a doctor such as eye drops, acne medicines, sleep aids, allergy medicine, and more

Orthodontia

Chiropractic care

Speech therapy

Acupuncture

Psychiatric care

How much can I and my business save?

The savings can add up quickly. On average business owners alone save around $5,000 on taxes. But the savings in self-employment and income taxes can vary based on the business. Here are two examples.

The first example is based on one from leading child care business authority Tom Copeland about a family child care provider (which can also apply to centers):

Without an HRA

There is a family child care provider who is a sole proprietor and is in the 22% income tax bracket.

She had $6,000 in health insurance premium costs and $4,000 in out-of-pocket expenses (including co-pays, prescription drugs, and eyeglasses for two family members). Her spouse is not eligible for health insurance so she can deduct all of her $6,000 in insurance premiums. (If her spouse was eligible for insurance, even if they turned down coverage, these would not be deductible).

Using the personal health insurance deductible for self-employed people, she can deduct only the health insurance premiums off of her income. So, she still pays self-employment tax on the $6,000 of business income that she had to qualify for this deduction, but will save on personal income tax.

The out-of-pocket expenses are only deductible when they exceed 7.5% of her adjusted gross income. In most cases, ordinary healthcare costs don’t reach this level, so these costs won’t be deductible.

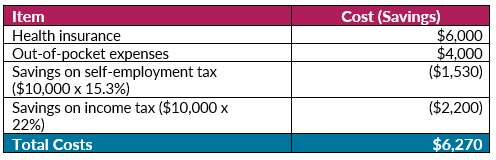

Here are the costs and savings for a provider not using an HRA:

Without an HRA

As you see, this provider had $10,000 in health expenses and theoretically paid $10,210 for it.

With an HRA

Now let’s say she had an HRA. Now she can deduct the full $10,000 as a business expense, eliminating both self-employment and income taxes.

Here’s what her costs and savings would be now:

As you see, this same provider had $10,000 in health expenses and paid $6,270 for it. Through an HRA, the provider saved an additional $3,730!

Through an HRA, the provider saved an additional $3,730!

Now let’s explore a second example, this time for a Center that is a Single Member LLC so it is treated as a sole proprietorship for tax purposes.

The center owner has four employees and has hired her 16-year-old daughter so she is eligible for her costs (we’ll go into that more a little later). She sets up an HRA with an annual limit of $1,000 as a way to increase compensation for her staff.

Here’s how much of the reimbursement each employee used:

Let’s now see the impact on taxes for the employer and employee.

For the employer:

The employer only had to pay $2,761.85 in reimbursements, less her tax savings, to offer this $4,550.00 benefit.

And how about her employees?

They will save on the employee side of payroll taxes and income tax. Assuming they are in the 22% tax bracket, their income tax savings would be:

In this example, we can see that not only did the owner benefit, but for $2,761.85 she was able to provide a potential $5,899.07 in value for her employees.

How is this different than a Health Savings Account?

Many employers may also consider a Health Savings Account (HSA). While an HSA can be valuable, an HRA tends to be more versatile and beneficial. One fundamental key difference is that an HSA must be paired with a high-deductible health insurance plan, while an HRA can be used with or without offering a business health insurance plan.

Here is a brief summary of the differences:

Does your business qualify?

Businesses with W-2 employees can qualify for an HRA. However, how you implement them and how business owners who are not W-2 employees can benefit depends on the type of business you are.

Here are the different paths for each business type:

C Corporation or an LLC treated as a C Corporation

Since all the company employees (including the owner) are W-2 employees, it can be implemented easily for everyone. You would put a plan in place and start accepting reimbursements.

Sole Proprietorships, Partnerships, Single Member LLCs, or Multi-member LLCs treated as Partnerships

Any W-2 employees will be able to enroll in the HRA, however owners and partners will not. If you can legitimately employ a spouse or child as a W-2 employee you are able to utilize an HRA for that hire. HRA coverage extends to them and their family (including yourself).

For example, a family child care provider who is a sole proprietor can hire her 16-year-old daughter part-time and create an HRA for the daughter that includes all family members (the daughter, the owner, a spouse, and siblings).

S Corporations and an LLC treated as an S Corporation

All existing W-2 employees and any owners who own less than 2% of the business can participate. Any owners who own more than 2% of the business, even though they are W-2 employees, cannot. Further, relatives of the business owner are considered in this case to be 2% or greater employees so cannot be used for eligibility. However, some business owners will create a separate Sole Proprietorship and employ a relative through that company to gain an eligible W-2 employee. This clearly needs to be justifiable for the business so make sure you do this in coordination with your tax professional.

How do I set up the plan?

You can hire a company to implement the plan for you or have your business implement it directly.

To start, you will want to create a plan document with the “rules” around the plan. You will want to include:

Which employees and their relatives should be eligible – for example, you may want to include only full-time employees or those who have been employed with you for a certain number of months or years.

The timing of reimbursements – typically this is monthly or quarterly to ensure timely payment and any rules around it, such as having to get payments in within the 30 days of the end of a month or quarter.

Eligible expenses and any exclusions – with any limitations or timing, such as having to use your existing insurance first.

Employer contribution limits – including the maximum benefit for a set period of time, such as for the month or year. Keep in mind that this should be considered “reasonable compensation” so you don’t want to exceed their current pay (so if you hire your spouse for $5,000 a year you should not allow up benefits to exceed that level).

These items need to be captured in a plan document. If you use an outside company, they will likely provide this document. If you self-implement there is an example to consider in Attachment A at the end of this page.

You should also have a simple form for each employee so they can list eligible dependents and acknowledge that they are opting to participate in the plan and that it may end at any time. A form like this should be signed and dated by every employee wanting to participate.

How do I implement an HRA?

With your plan in place, you can now start reimbursing costs. If you have engaged an outside company, they will have an online system or forms for you to use. If you are running your own system, you should have a form (it can be paper or a simple online form) where employees can request reimbursement and provide proof of payment for expenses, such as receipts. These should be reviewed by an independent party – that is, if Employee A normally processes reimbursements, she should not review her own but instead as the owner or another employee. If it is just you and a relative, you should review all the reimbursements.

Once approved, you can write a check or process the reimbursement through your payroll company and log costs as health-related expenses.

Do I have to report the plan to the government?

Yes, every year, by July 15th you need to file a Form 720 with the federal government to pay a small tax for each participant. Don’t worry – the tax is small. For example, in 2022, the maximum fee is $2.79 per average participant.

To complete your Form 720, start with Part I where you will enter your business information at the top.

Then move to Part II on page two. You will want to enter the information on IRS number 133, PATIENT-Centered Outcomes Research Fee. Specifically, under Applicable Self-Insured Plans, you will enter the average number of employees covered for the year in the column and then multiply it by the rate in column (b). The line you should use will be determined by when your plan year ends. For example, if you started your plan on November 1, 2022, the plan year-end would be 12 months later – October 31, 2023. You then multiply the average number of employees by the rate to get the fee in column (c) and the number for the Tax Column.

In Part III you will want to put the total tax from Part II on lines 3 and 10. This will be the amount you will send to the federal government. Also, put in your name, and the date, and make sure you sign before sending.

Finally, you should send a check written to the US Treasury and mail it to:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0009

(note: you use the same address no matter which state your business is in).

Attachment A: Example Plan Document

Happy Bear Child Care (“Employer”) hereby establishes this Section 105 Medical Expense Reimbursement Plan (the “Plan”) for the exclusive benefit of its employees.

Medical Expense Reimbursement. Effective as of XXXXXX, Employer shall reimburse all eligible employees on the basis described in Paragraph Three below for medical expenses described in Paragraph Three that they incur on behalf of themselves, their spouses, and their dependents (as defined in Internal Revenue Code Section 152).

Eligibility. All employees shall be eligible except employees who work 35 hours or less on average a week.

Qualifying Benefits. “Medical expenses” shall include any expense qualifying under Internal Revenue Code Section 213(d) up to $75 a month. Employer will only pay expenses that are not covered by insurance policies or benefits of the Employer, employee, or the employee’s family.

Reimbursement. Employer may reimburse the employee for eligible expenses or pay medical providers directly. Employer shall reimburse employee only in the event and to the extent that such expenses are not covered by any insurance policy, policies, or benefits, whether owned by Employer or employee, provided under any other accident or health insurance plan or provided by federal or state governments or agencies. Employees applying for reimbursement shall submit all premium notices and eligible bills not more than 30 days after the end of the month in which they are incurred. Failure to comply with this requirement may terminate employees’ right to reimbursement for expenses not submitted in a timely manner.

Unfunded Plan. This plan shall be unfunded for purposes of the Employee Retirement Income Security Act (ERISA). Plan benefits shall be paid out of Employer’s general assets.

Amendment and Termination. Employer reserves the right to amend or terminate the Plan at any time with 60 days written notice to employees before termination. Such action shall not deny any employee’s right to claim reimbursement for expenses incurred before such amendment or termination.

Notice. Employer shall provide all eligible employees with a copy of this Plan within 90 days of eligibility.

Exclusions. Employer intends that this Plan and all benefits payable under this Plan shall qualify for exclusion from eligible employees’ gross income under Internal Revenue Code Sections 105 and 106. Employer reserves the right to amend or terminate this Plan in the event that such benefits no longer qualify for such exclusion.

The Employer adopts this plan as of the date specified in Paragraph 1.

______________________________________________

Signature

_____________________________________________

Print Name and Title

Additional Assistance

For more early care and education resources, please visit the Wisconsin Early Childhood Association (WECA) website. If you are not a member of WEESSN, click here to learn about the business training and support it offers. Ready to join WEESSN? Click here!

Disclaimer: The information contained in this presentation has been prepared by Civitas Strategies Early Start on behalf of the Wisconsin Early Childhood Association and is not intended to constitute legal advice. The parties have used reasonable efforts in collecting, preparing, and providing this information, but neither Civitas Strategies Early Start nor Wisconsin Early Childhood Association guarantees its accuracy, completeness, adequacy, or currency. The publication and distribution of this presentation are not intended to create, and receipt does not constitute, an attorney-client relationship. Reproduction of this presentation is expressly prohibited.